By Billy Lee also Published in: MIXED MARKET ARTIST

(The above featured image is The Future is Here listed on OpenSea)

There is a force of will at work in the markets. Perspective plays its part in the pricing of securities.

Many exclusively discuss pricing mechanisms like supply and demand, measurable differences in technology, etc.

However, there is a qualitative consideration that might lead to some insight on the subject of NFTs (and maybe other recent phenomena like meme trades).

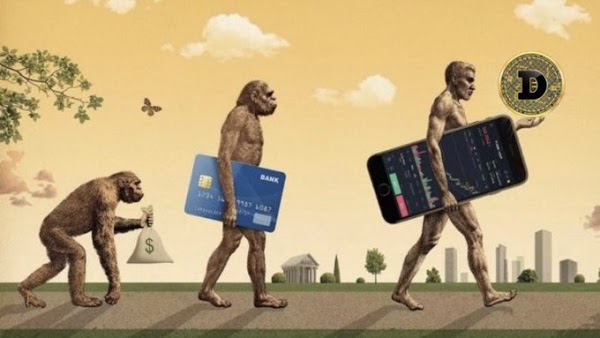

The individuals involved in the NFT world are generally younger, and they have a different perspective than older folks.

Think…for those who are older than 35, we have mostly lived out an experience where we trade our labor for our money. A major component of that labor is our time.

When we measure the value of something, we are bound to take this into account at a visceral level. How much time of my life am I going to trade for that thing? This is a major part of a mature person’s calculation.

Now, let’s consider what has been at work for a significant proportionate time in many younger people’s lives.

We are coming onto 2 years in dealing with the pandemic, significant political upheaval, and the creation of money out of thin air through unprecedented fiscal and monetary measures (stimulus checks have become a part of the vernacular and the culture).

If the average 30-year-old began looking at the markets at 20 (they are probably watching Twitter, not reading Graham and Dodd), 20 percent of their total experience is with market mechanics that are a “LITTLE UNIQUE”.

…and the creation of money out of thin air through unprecedented fiscal and monetary measures (stimulus checks have become part of the vernacular and the culture).

Younger people don’t see money as a trade for labor and time. They see it as something to throw into the next trend – the strong trends of late are the ones that can serve to enrich materially as well as serve ego and emotion.

Think vengefully short squeezing the hedge fund set. Think producing rebellious, punk rock inspired graphic art and laughing to the bank.

Couple all of this with pump and dump schemes taking place in real time and being celebrated as a kind of social activism, and you get NFT’s and the next thing and the next..

This is not to say NFTs are not viable or here to stay. The good ones will prevail, but Graham and Dodd will eventually prevail over a long enough timeline!

By Billy Lee

Billy Lee, CEO of Great White Financial, is a sportsman, businessman, artist, speaker, writer, and producer.

Billy is the Founder of the Wellness Institute for Economic Growth and Kairos Athletics.